Daily Market Analysis and Forex News

Week Ahead: US500 faces triple threat – Geopolitics, Powell & PCE

FXTM’s US500 ↑ 1% MTD, less than 3% away from ATH

Trump delays decision on Iran strike by two weeks

Powell’s testimony + US PCE = potential breakout?

US PCE forecasted to move US500 ↑ 1.3% or ↓ 1.0%

Technical levels: 6060, 6000 & 5920

A cautious sense of relief has spread through markets after President Trump delayed deciding on attacking Iran by two weeks.

However, the ongoing Middle East conflict is set to weigh on investor confidence ahead of another heavy event-packed week.

Speeches by various policymakers, top-tier economic data including the Fed’s preferred inflation gauge and Powell’s testimony could translate to fresh trading opportunities:

Sunday, 22nd June

- USDInd: San Francisco Fed President Mary Daly

- Tesla: Tentative launch of Robotaxi service in Texas

Monday, 23rd June

- GER40: Germany HCOB Manufacturing & Services PMI

- JPY: Japan au Jibun Bank Manufacturing PMI

- TWN: Taiwan jobless rate

- UK100: UK S&P Global Manufacturing & Services PMI

- RUS2000: US S&P Global Manufacturing & Services PMI, Fed speak

Tuesday, 24th June

- CN50: China’s National People’s Congress

- CAD: Canada CPI

- GER40: Germany IFO business climate

- UK100: BOE Governor Andrew Bailey testimony

- US500: Fed Chair Jerome Powell testimony, New York Fed President John Williams

Wednesday, 25th June

- AUD: Australia CPI

- NZD: New Zealand trade

- JPY: BOJ board member Naoki Tamura speech

- US500: Fed Chair Jerome Powell testimony

Thursday, 26th June

- SG20: Singapore industrial production

- GBP: BOE Governor Andrew Bailey speech

- US30: US revised GDP, initial jobless claims, Fed speak

Friday, 27th June

- CN50: China industrial profits

- CAD: Canada GDP

- EUR: Eurozone economic confidence, consumer confidence

- JPY: Japan Tokyo CPI, unemployment, retail sales

- US30: Fed releases annual bank stress test results

- US500: US personal income, PCE price index, University of Michigan consumer sentiment, Fed speech

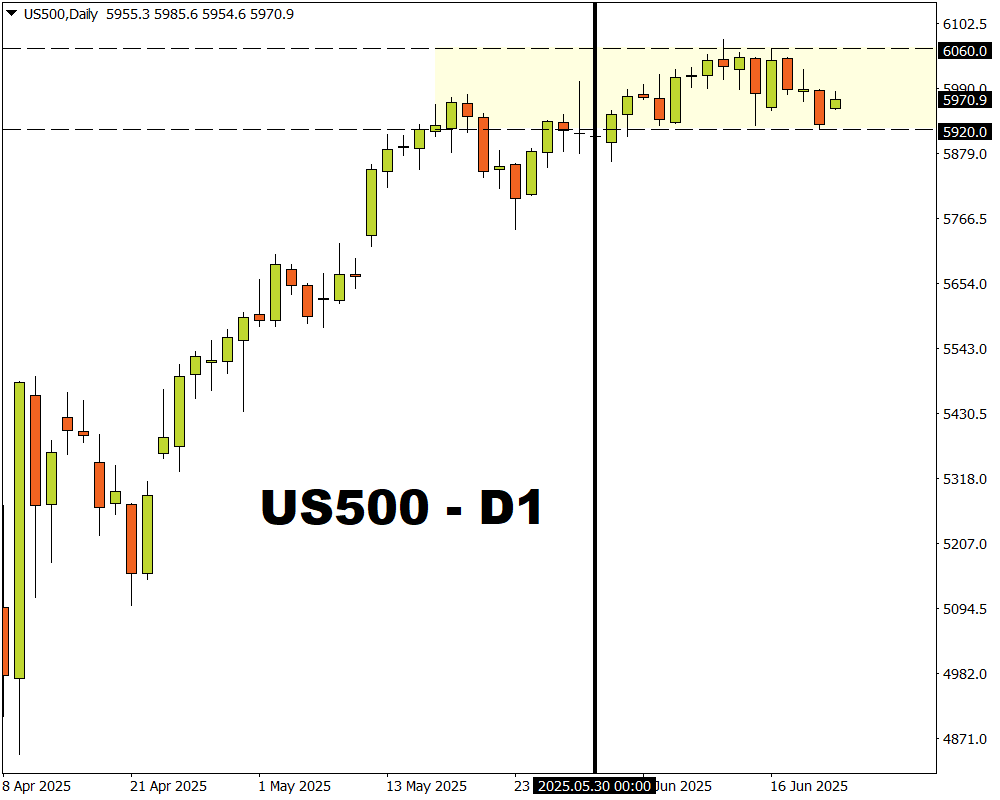

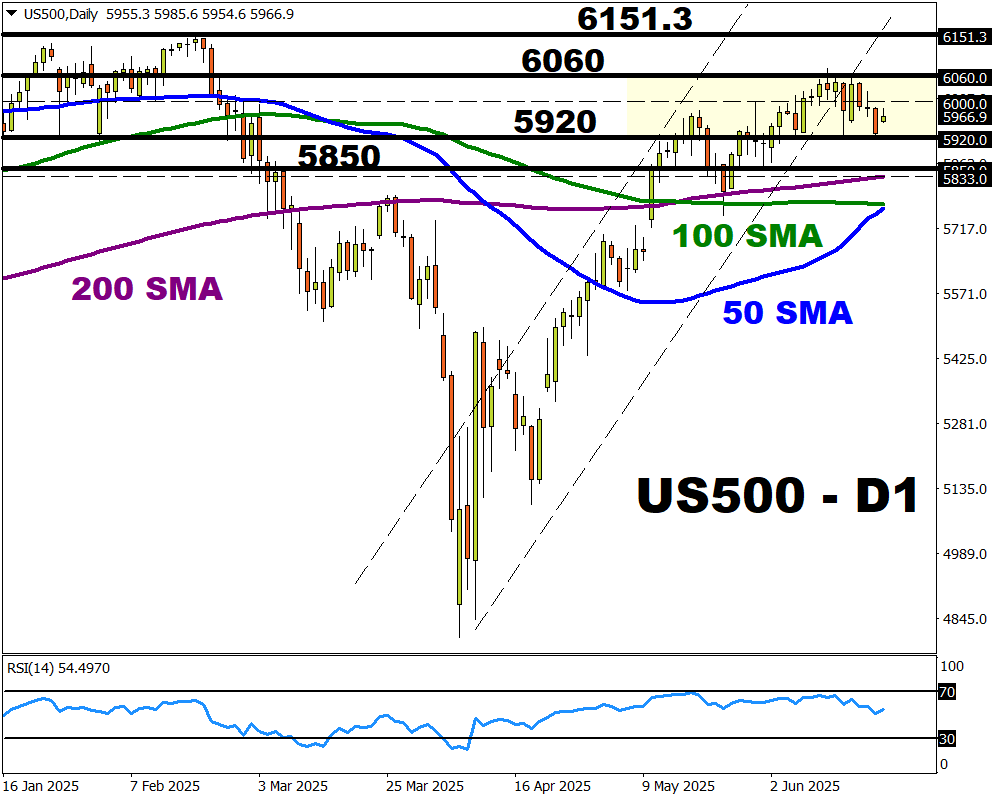

Our attention is drawn to FXTM’s US500, which has been confined within a daily range since the start of June.

Note: FXTM's US500 tracks the underlying S&P 500 index

Recently, US equities have been pressured by mounting geopolitical risks, despite the Federal Reserve still penciling in two interest rate cuts for 2025.

Still, US500 is up roughly 1% this month and trading less than 3% away from its all-time high at 6151.3.

Here are 4 factors that could trigger a major breakout:

1) Ongoing Middle East conflict

Israel and Iran have exchanged missile attacks for one week after tensions escalated last Friday.

The conflict between both sides has shown no signs of cooling with investors watching whether the United States will get involved. Although Trump has delayed this decision by two weeks, any hints of potential actions could influence risk sentiment.

Any signs of the United States holding off on joining the Israel-Iran conflict may support risk appetite - keeping the US500 buoyed.

Should expectations mount around the US attacking Iran, this may spark fears of a wider conflict. Such development may hit the US500 as risk aversion intensifies.

2) Fed Chair Powell’s 2-day Testimony

Fed Chair Jerome Powell’s semi-annual testimony before Congress may provide key insight into future policy moves.

During June’s FOMC meeting, Powell stated that the Fed was ‘well-positioned to wait’ before moving further on rates. He also expressed concerns over the effects of tariffs on inflation.

Should Powell repeat the same message and strike a hawkish note, this could weigh on the US500.

If the Fed Chair sounds more dovish than expected and signals a rate cut in September, the US500 may rise.

3) US May PCE report

The Fed’s preferred inflation gauge – the Core PCE could influence expectations about when the central bank will cut rates in the second half of 2025.

Markets are forecasting PCE deflators to rise in May with the core figure nudging up 2.6% year-on-year compared to 2.5% seen in the previous month. Ultimately, more signs of rising price pressure may shave bets around lower US interest rates.

Traders are currently pricing in a 68% probability of a 25-basis point cut by September.

Beyond the PCE report, it will be wise to keep an eye on speeches by a host of Fed officials and other US data, including PMI’s which may influence the US500.

US500 is forecasted to move as much as 1.3% or decline 1.0% in a 6-hour window post release.

The US500 may slip on signs of rising price pressures in the United States.

A cooler-than-expected PCE report could support the US500.

4) Technical forces

The US500 remains trapped within a range with support at 5920 and resistance at 6060.

A solid daily close and breakout above 6000 may open a path toward 6060 and 6151.3.

Sustained weakness below 5920 may trigger a selloff toward 5850, the 200-day SMA and 100-day SMA.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.