Daily Market Analysis and Forex News

Week Ahead: USDJPY set for volatile price swings?

Yen expected to be the most volatile in G10 space vs USD

Ongoing US-Japan talks, geopolitics & data could rock JPY

Over the past year US CPI triggered moves of ↑ 0.7% & ↓ 1.7%

Bloomberg FX model: USDJPY has 72% of trading within 141.26 – 146.52 over 1-week period

Technical level: 142.30 & 145.00

Even as we await the US jobs report later today (Friday, 6 June), investors are keenly aware of the string of key data points over the coming week.

The Japanese Yen is expected to be the most volatile G10 currency versus the USD over the next one-week.

This could be based on ongoing US-Japan trade talks, geopolitical risk and high-impact economic data.

And these key data releases from major economies could present fresh trading opportunities in the week ahead:

Sunday, 7th June

- CNH: China forex reserves

- EUR: ECB President Christine Lagarde speech

- JPY: BOJ Deputy Governor Shinichi Uchida speech

- Fed’s pre-decision communications blackout

Monday, 9th June

- CN50: China trade, CPI, PPI

- JPY: Japan GDP (final), current account

- TWN: Taiwan trade

- RUS2000: US wholesale inventories

Tuesday, 10th June

- AUD: Australia Westpac consumer confidence, NAB business confidence

- JPY: Japan money stock

- ZAR: South Africa manufacturing

- GBP: UK jobless claims, unemployment

Wednesday, 11th June

- JPY: Japan PPI

- USDInd: US May CPI, federal budget balance

- GBP: UK government spending review 2025

Thursday, 12th June

- UK100: Monthly GDP, UK industrial production, trade

- US500: US PPI, jobless claims

Friday, 13th June

- EU50: Eurozone industrial production

- GER40: Germany CPI

- JPY: Japan tertiary industry, industrial production (final)

- NZD: New Zealand Business manufacturing PMI

- USDInd: US University of Michigan consumer sentiment

At the time of writing, the Yen is the worst-performing G10 currency versus the USD month-to-date, barely moving against the greenback.

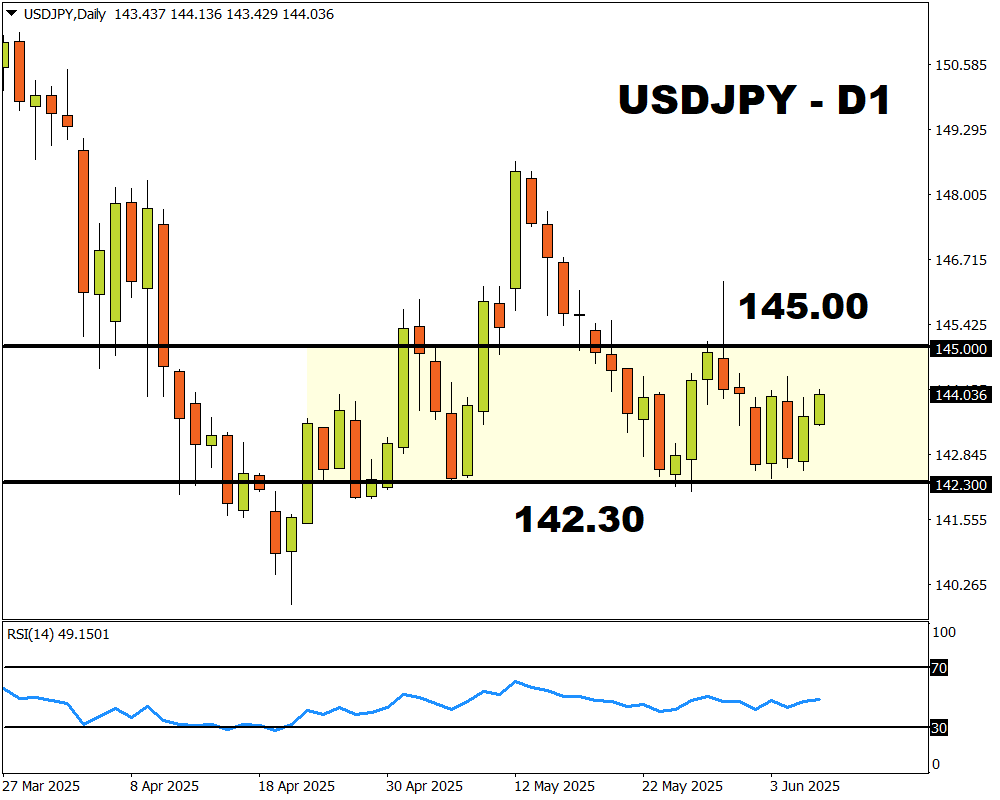

Indeed, prices have been trapped within a range on the daily timeframe with support at 142.30 and resistance at 145.00.

A breakout could be on the horizon, but this may require a fresh fundamental catalyst.

Here is what you need to know:

1) Ongoing US-Japan trade talks

Japan and the United States have been engaged in trade talks since mid-April following Trump’s liberation day tariffs.

The country has been hit with a 25% tariff on autos and parts, a 10% universal tariff that will rise to 24% in early July, in addition to Trump’s 50% tariff on steel and aluminum.

This week, Japan’s top trade negotiator met with US Commerce Secretary Howard Lutnick.

- Any positive news or signs that a deal could be reached may boost sentiment toward the Japanese economy, supporting the Yen.

- Should talks drag on with no sign of a deal being reached, this fuel concerns over Japan’s economic outlook – hitting the Yen as a result.

2) BoJ deputy governor speech + Japan economic data

Over the weekend, a speech by the BoJ deputy governor may provide some clues about future policy moves.

To be clear, the incoming data from Japan will be the most finalized estimates, so this market reaction may be muted. However, any major upside or downside surprises could spark some action and influence BoJ rate expectations.

Traders are currently pricing in a 70% probability of a 25-basis point BoJ hike by the end of 2025.

3) US May CPI report

The May Consumer Price Index (CPI) that will be published on Wednesday, 11th June, could influence Fed cut bets.

Markets are forecasting:

- CPI year-on-year (May 2024 vs. May 2025) is expected to rise 2.5% from 2.3%.

- Core CPI year-on-year to rise 2.9% from 2.8%.

- CPI month-on-month (May 2025 vs April 2025) to remain unchanged at 0.2%

- Core CPI month-on-month to rise 0.3% from 0.2% in the prior month

Over the past 12 months, the US CPI has triggered upside moves of as much as 0.7% or declines of 1.7% in a 6-hour window post-release.

- A hotter-than-expected US CPI print could push the USDJPY higher as Fed cut bets cool.

- Should the inflation report print below forecasts, this may drag the USDJPY lower.

Traders are currently pricing in 2 Fed rate cuts by the end of 2025, with the odds of a third one at 20%.

4) Technical forces

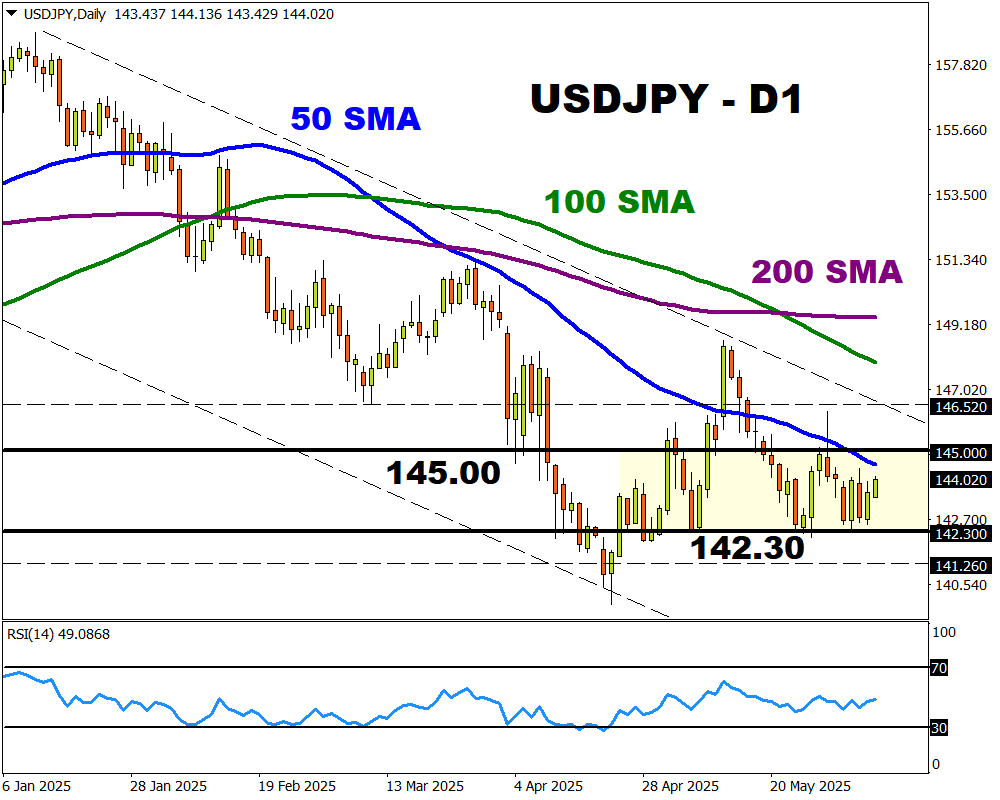

The USDJPY remains in a range on the daily charts with key support at 142.30 and resistance at 145.00. Prices are trading below the 200, 100 and 50-day SMA.

- A breakout and daily close above the 50-day SMA at 144.60, may open a path toward 145.00 and 146.52– the upper limit of the Bloomberg FX model.

- Sustained weakness below 143.00 could trigger a selloff back toward support at 142.30 and 141.26 - the lower limit of the Bloomberg FX model.

Bloomberg’s FX model forecasts a 72% chance that USDJPY will trade within the 141.26 – 146.52 range, using current levels as a base, over the next one-week period.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.