Daily Market Analysis and Forex News

Market round-up: Fed/BoE hold, Geopolitical risk, Oil soars

BoJ, Fed & BoE leave rates unchanged

Israel-Iran conflict grips global sentiment

Fed still sees 2 rate cuts in 2025

USDInd & Gold gain on risk-off mood

Oil gains over 5% this week on supply risk

It has been another week defined by mounting geopolitical risk as the Israel-Iran conflict grips financial markets.

Global equities have been hit by the risk-off mood, with investors rushing toward safe-haven destinations like the dollar and gold. Oil prices are up over 5% this week as fears mount over potential supply disruptions in a region that produces a third of the world’s crude.

Beyond geopolitics, the Bank of Japan, Federal Reserve and Bank of England all left their respective interest rates unchanged.

Here is what you need to know…

Fed still penciling in two rate cuts

The Fed left interest rates unchanged on Wednesday as expected.

However, the real surprise was that officials continued to pencil in two rate cuts in 2025. Regarding the economic outlook, GDP growth forecasts were lowered while the inflation outlook was raised for this year.

Jerome Powell warned about economic uncertainty and inflation risks impacting the Fed’s ability to cut rates.

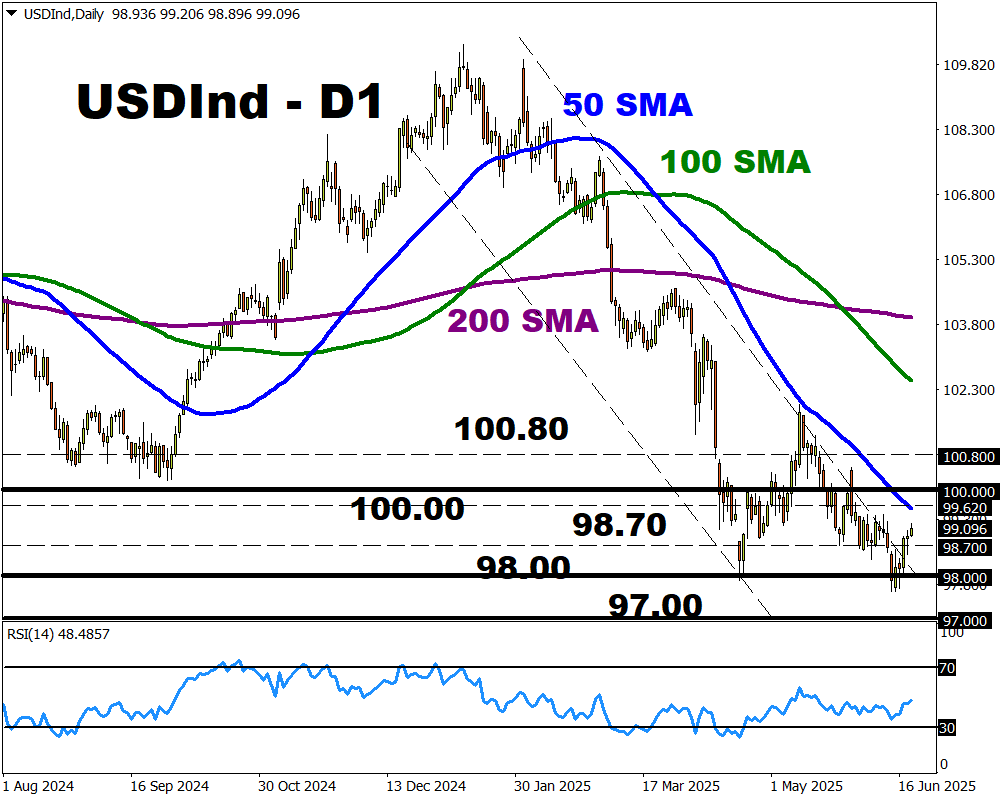

Looking at the charts, FXTM’s USDInd has edged higher – fuelled by the risk-off mood.

A solid daily close above the 50-day SMA may open a path toward 100.00 and 100.80.

Weakness below 98.70 could see a decline back 98.00 and 97.00.

Pound slips as BoE holds rates

The Bank of England held interest rates at 4.25% in a more divided vote than expected.

Six policymakers voted to keep rates unchanged while three voted for a 25-basis point cut.

Overall, the BoE expected a significant slowing of pay growth in 2025 and expressed concerns over the conflict in the Middle East.

Traders are pricing in a 68% probability of a 25-basis point BoE rate cut by September with a move fully priced in by October.

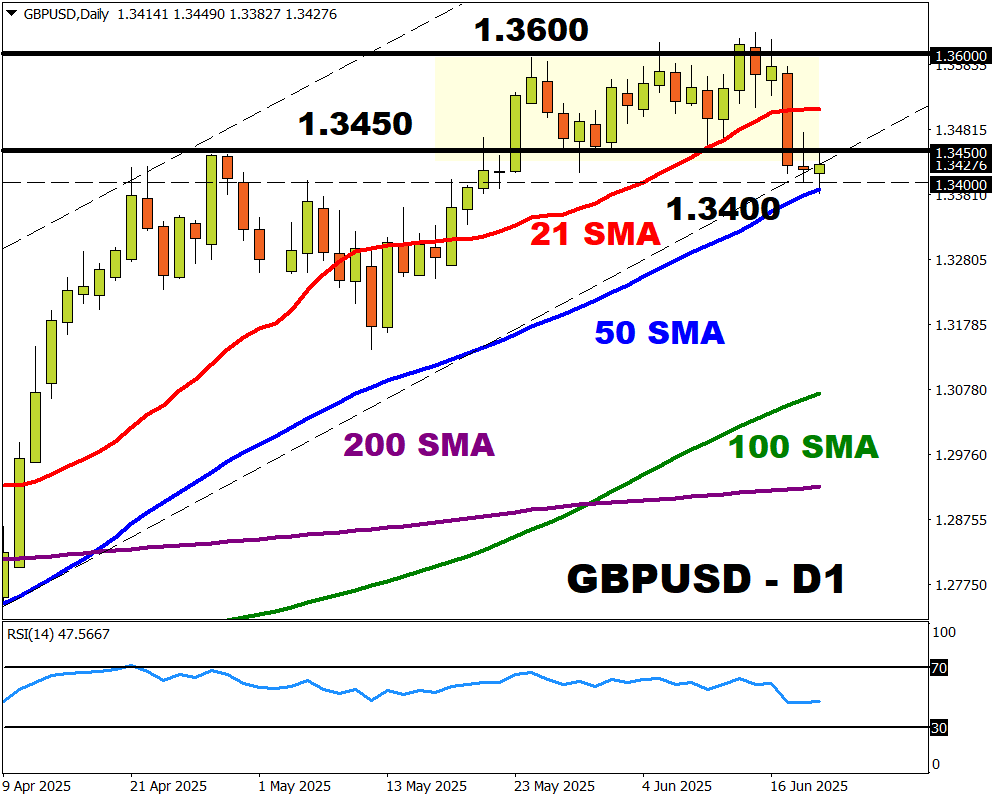

Talking technicals, the GBPUSD remains under pressure on the daily charts with sustained weakness below 1.3400 signaling further downside.

Oil hits 5-month high

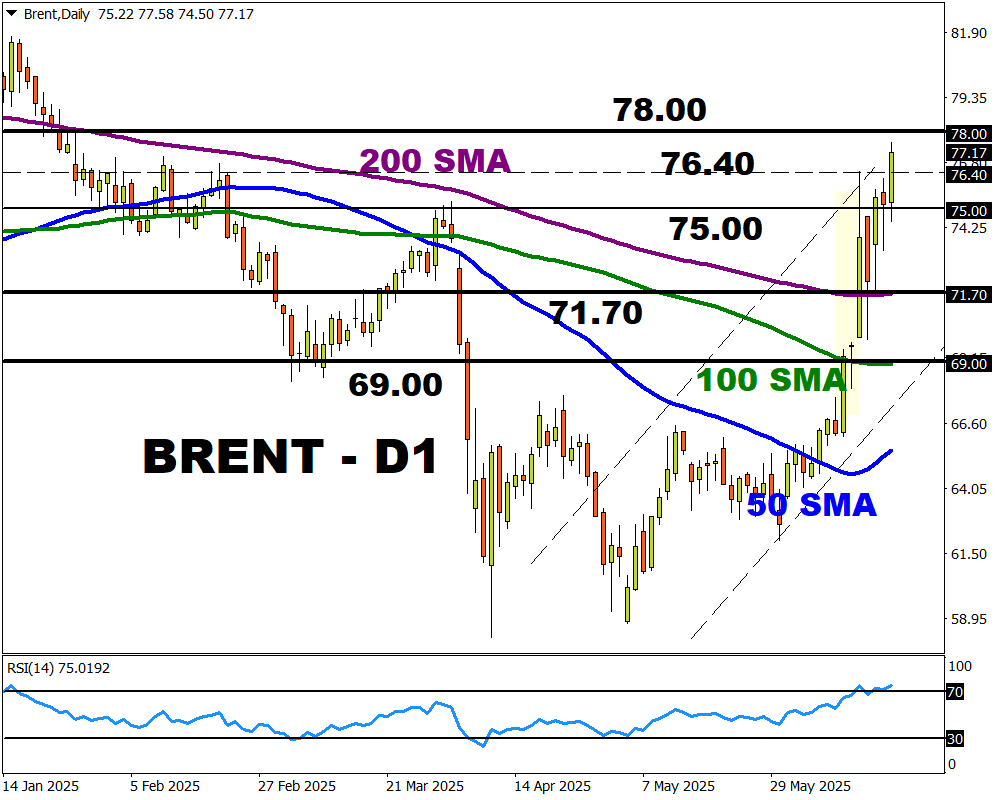

Brent has jumped to levels not seen since January 2025 as investors monitor the developments in the Middle East.

Markets are waiting to see whether President Donald Trump will bring the US into the conflict between Israel and Iran.

Should this become reality, the threat of a wider conflict disrupting supply in the region could boost oil prices higher. An attack on Iran’s gas-producing infrastructure is a concern, but the real fear is any disruptions on the Strait of Hormuz where Middle East producers ship about a fifth of the world’s daily output.

Brent has gained over 5% this week, pushing monthly gains to over 25%. The next key level of interest can be found at $78.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.