Daily Market Analysis and Forex News

Week Ahead: Crude caught in crosswinds ahead of OPEC+ showdown

Crude ends April ↓ 18.6%

OPEC+ expected to sign off another supply hike

Positive US-China trade may support oil bulls

Fed decision sparked moves of ↑ 0.4% & ↓ 0.9% over past year

Technical levels: $65, $60 & $55

As the countdown draws closer to the key US jobs report this afternoon (Friday, 2nd May), markets are bracing for more volatility in the week ahead.

An influx of high-impact data, risk events and key central bank decisions could present fresh trading opportunities:

Saturday, 3rd May

- AUD: Australia general election

- OIL: OPEC+ meeting on production levels

Sunday, 4th May

- Asian Development Bank annual meeting

Monday, 5th May

- UK markets closed for Bank holiday

- USDInd: US ISM services

Tuesday, 6th May

- AUD: Australia building approvals

- CN50: China Caixin services PMI

- EUR: Eurozone HCOB services PMI, PPI

- US500: US Treasury Secretary Scott Bessent testimony

Wednesday, 7th May

- CNY: China forex reserves

- EUR: Eurozone retail sales

- GER40: Germany factory orders

- TWN: Taiwan CPI

- US500: US Fed rate decision

Thursday, 8th May

- GER40: Germany industrial production

- ZAR: South Africa manufacturing production

- UK100: BOE rate decision

- SEK: Sweden rate decision

- RUS200: US jobless claims

Friday, 9th May

- CN50: China trade

- JP225: Japan household spending, cash earnings

- CAD: Canada employment

- USDInd: Fed governors Lisa Cook, Christopher Waller, St. Louis Fed President Alberto Musalem, Cleveland Fed President Beth Hammack, Chicago Fed President Austan Goolsbee speech

Our focus lands on oil benchmarks which have shed over 17% year-to-date amid global recession fears and oversupply worries.

Crude prices have recently rebounded on easing trade tensions and new sanctions on Iran. However, the global commodity is still headed for a weekly loss of more than 6%.

And things could spice up further in the week ahead. Here are 4 reasons why:

1) OPEC+ meeting on production levels

OPEC+ has brought forward its meeting to discuss June production levels. The meeting originally set for Monday 5th May will now be on Saturday 3rd May.

Earlier in April, Saudi Arabia shocked markets by pushing OPEC+ for faster output increases in May after Kazakhstan and Iraq produced well above quotas.

Markets expect the cartel to sign off on another supply surge to punish over-producing members.

But most importantly, infighting within the cartel and overproduction could be a recipe for disaster for oil, especially if it leads to a “free-for-all” where members pump at will.

- Oil prices may tumble if OPEC+ pushes for faster production hikes with any signs of internal instability fuelling downside pressures.

Should OPEC+ surprise by slowing down or pausing output hikes, this could boost oil prices as oversupply fears cool.

2) US-China trade talks

Market sentiment has received a boost after China said it’s evaluating trade talks with the United States. This comes after weeks of conflicting reports and uncertainty around US-China trade talks.

If this soothes tensions and opens the doors to concrete negotiations, this could cool concerns about a global recession.

- More positive progress with US-China trade talks may support oil prices as investors become more hopeful about the demand outlook.

Should the talks lead to more uncertainty or result in renewed tensions, oil prices may take a hit.

3) Fed rate decision

The Fed is widely expected to leave interest rates unchanged at its May meeting, but all eyes will be on Fed Chair Jerome Powell’s press conference.

Friday’s incoming US jobs report along with developments on the trade front, may influence what tone Powell strikes on Wednesday 7th May.

Traders are currently pricing in 3 rate cuts in 2025 with the probability of a 4th one by December at 67%. Any major shifts to these expectations may influence oil prices.

- Lower interest rates could stimulate economic growth, which fuels oil demand.

- Lower interest rates may also lead to a weaker dollar, boosting oil which is priced in dollars.

The same can be said vice versa.

- If Powell strikes a hawkish note and the dollar appreciates, oil prices may slip.

If Powell sounds more dovish and signals faster rate cuts, oil prices may jump.

Over the past 12 months, the Fed rate decision has triggered upside moves on CRUDE of as much as 0.4% or declines of 0.9% in a 6-hour window post-release.

4) Technical forces

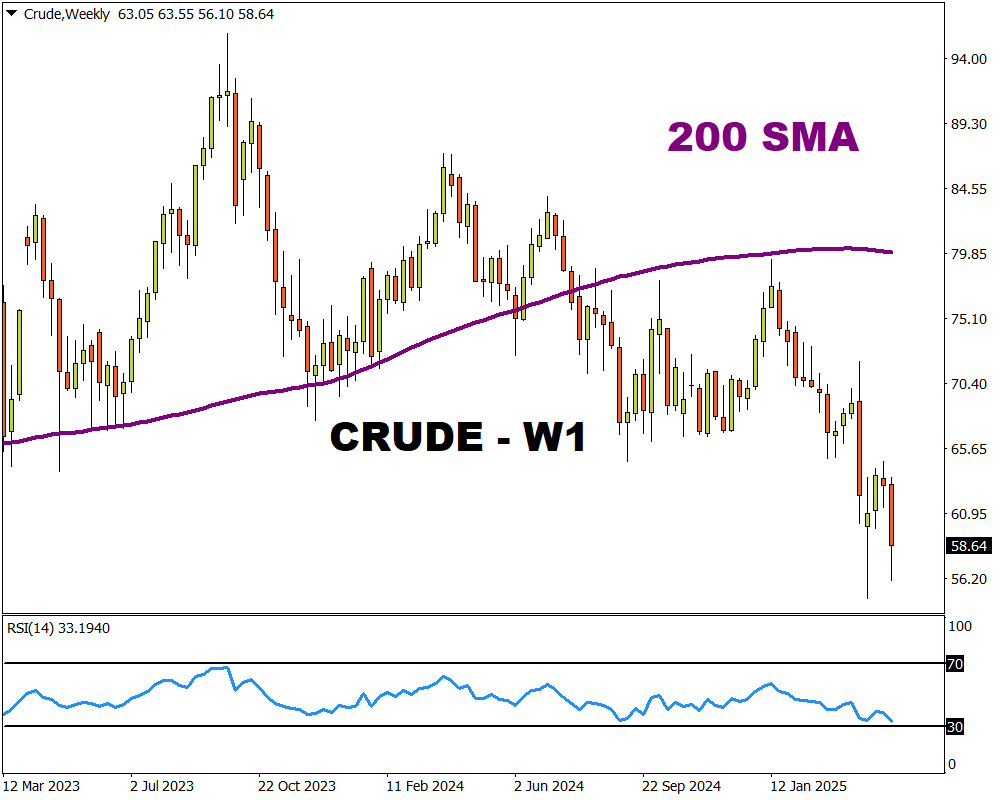

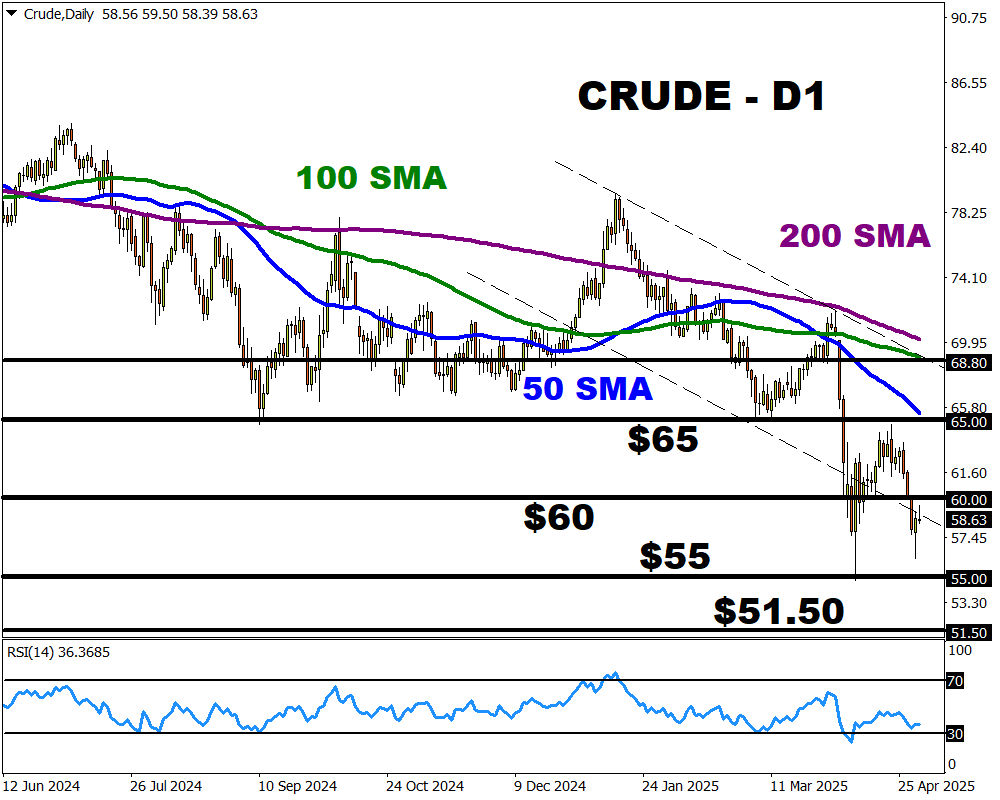

Crude is under pressure on the daily charts with prices trading below the 50, 100 and 200-day SMA. However, the Relative Strength Index (RSI) is close to 30, signalling that prices are oversold.

- A solid breakout and daily close above $60 may pave a path toward the 50-day SMA near $65.00 and potentially the 100-day SMA $68.80 in the medium to longer term.

Should $60 prove to be a tough resistance, prices may slip back towards $55 and levels not seen since January 2021 at $51.50.

Note: This chart was created before the release of the US NFP report on Friday 2nd May.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.