EURUSD may be gearing up for a major breakout as the technicals and fundamentals align.

Over the past few months, euro bulls have certainly dominated the scene – standing their ground in the G10 space thanks to fundamental forces.

Trade Of The Week: EURUSD In Breakout Mode?

Week Ahead: Hawkish Bank of Canada may drag USDCAD lower

The Canadian Dollar has the smallest year-to-date gain out of all G10 currencies against the US dollar.

Only the Norwegian Krone, another oil-linked currency, has had it worse so far in 2023, with a 0.86% percent year-to-date decline versus the greenback at the time of writing.

Dollar tumbles after disappointing US data

Concerns about an incoming economic slowdown have hit markets, while continued hawkish rhetoric by Fed speakers has added to negative risk sentiment.

EURUSD H4: Bears ready to pounce if Bulls fail to breach key resistance

The EURUSD on the H4 time frame was in an uptrend until 16 January when a last higher top was recorded at 1.08735.

A closer look at the Momentum Oscillator reveals negative divergence between point “a” and “b” when comparing the tops at 1.08671 and 1.08735. This could have alerted technically inclined traders that the bullish trend might lose power.

Trade of the Week: Yen on high alert with BoJ decision looming

Brace yourself!

We could be in for the-most-volatile week for USDJPY since the onset of the Covid-19 pandemic, at least going by the 1-week implied volatility for this pair:

Week Ahead: USDJPY set for wild Wednesday

The Japanese Yen has been the best-performing G10 currency versus the US dollar since end-October.

And there’s certainly been a lot of interest for JPY late, considering how our Dec 20th report was FXTM’s most-read article for all of 2022 (“Why is the Japanese Yen soaring?”).

Markets Slip On Hawkish Fed Remarks

It’s a new year but the same old story with markets sensitive to Fed rate hike bets and hawkish chatter by policymakers.

Asian shares were knocked lower during early trading as investors evaluated comments from two Federal Reserve officials overnight. A sense of caution ahead of the key US inflation report on Thursday dampened the overall mood, encouraging investors to adopt a guarded approach towards riskier assets.

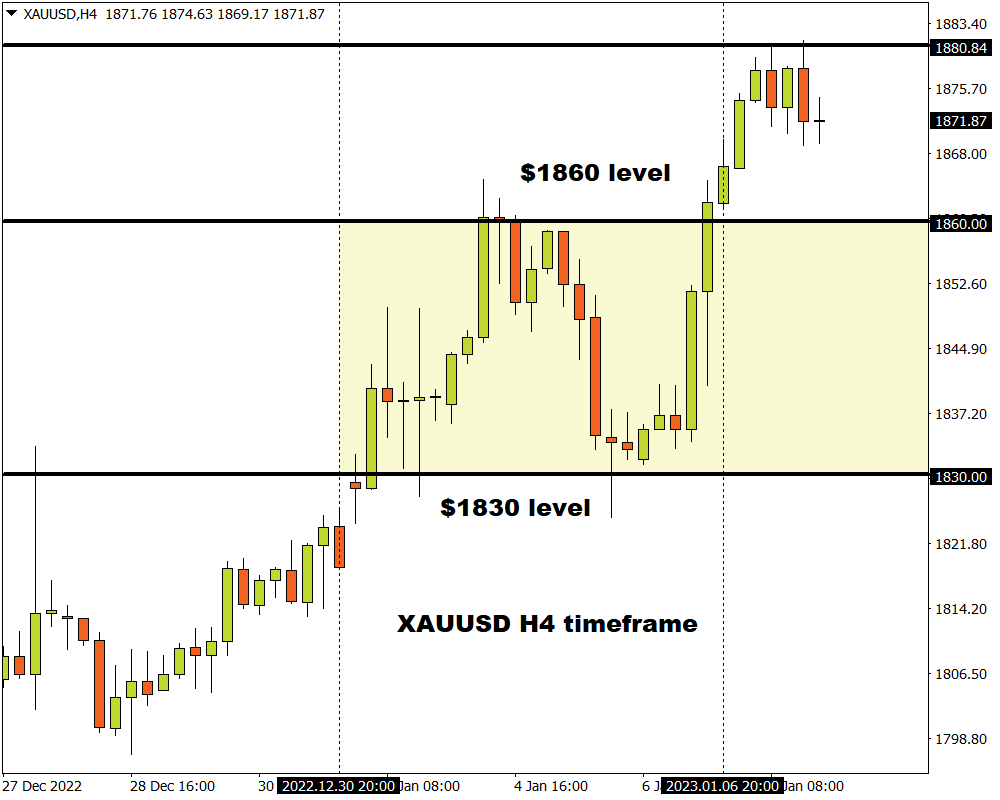

Trade Of The Week: Gold Eyes Key US Inflation Data

Gold is certainly glittering, gaining 2.3% in the first full trading week of 2023 alone.

The precious metal continues to draw ample strength from a softer dollar, falling Treasury yields, and growing expectations of a less hawkish Federal Reserve. Last Friday’s mixed US jobs report added fuel to the bullish momentum, resulting in a weekly close above resistance at $1860.

Week Ahead: Can US Dollar fend off “death cross”?

The US inflation outlook, and how it’ll impact the Fed’s plans for raising US interest rates, is set to come into sharpened focus over the coming week which also features these major data releases and events:

Monday, January 9