As we close out the month and head into the first days of March, here are the scheduled economic data releases and events that could move markets over the coming week:

Monday, February 27

Week Ahead: 3 reasons why EURUSD may see a rebound

As we close out the month and head into the first days of March, here are the scheduled economic data releases and events that could move markets over the coming week:

Monday, February 27

USDJPY could see a freaky Friday

Yen traders are eagerly anticipating the slightest policy clues that may emanate tomorrow (Friday, 24 February), when Bank of Japan (BoJ) Governor nominee, Kazuo Ueda, addresses parliament.

Sentiment Shaky Ahead Of Fed Minutes And “Higher For Longer” Rates

Week Ahead: 3 reasons to watch NZDUSD

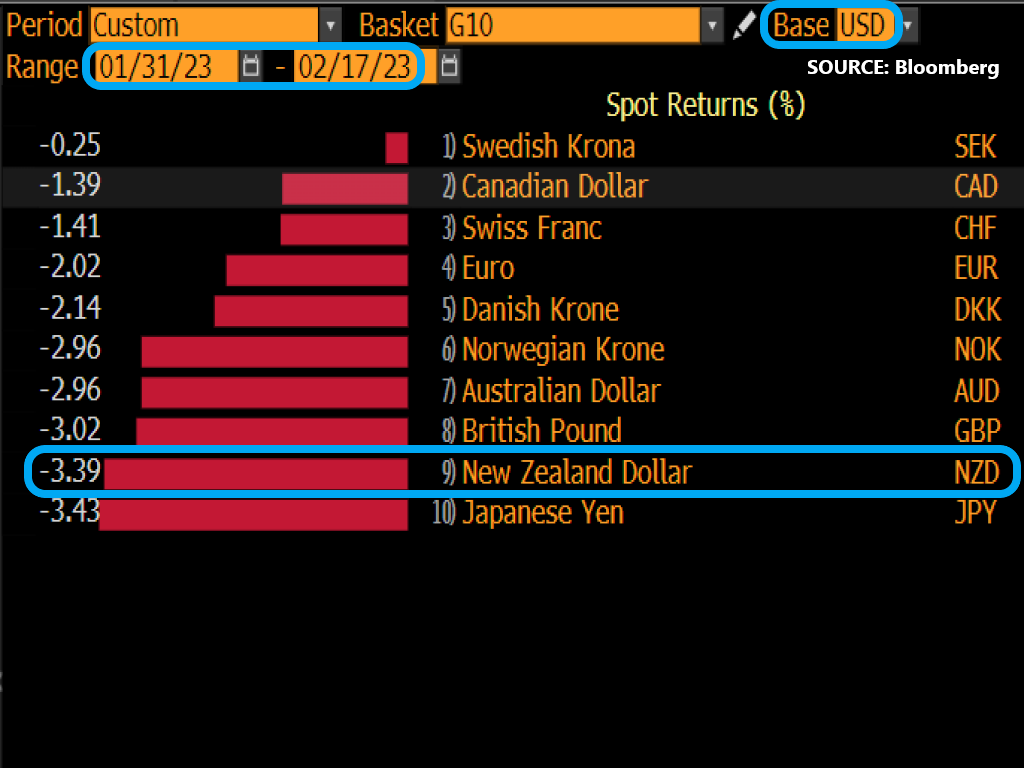

The New Zealand dollar (NZD) is the second worst-performing G10 currency against the US dollar so far this month, with NZDUSD having fallen by about 3.4% month-to-date.

Market caution returns on hot US CPI data

Asian shares flashed red on Wednesday along with US futures as investors evaluated sticky American inflation data and remarks from Fed officials. European futures are pointing to a negative open this morning amid the cautious sentiment and this could find its way back to Wall Street later today.

Trade Of The Week: GBPUSD Waits For Directional Catalyst

Week Ahead: USDJPY to feel the love this Valentine’s Day?

This Valentine’s Day, USDJPY is set to react to major clues on what’s next for the US and Japanese central banks respectively.

Mid-Week Technical Outlook: Commodities & Indices

European markets flashed green on Wednesday, tracking gains in Wall Street overnight. A less hawkish than feared Jerome Powell injected global equity bulls with renewed confidence, propelling the S&P500 more than 1%. Stock markets also drew fresh support from positive earnings which boosted market sentiment and sweetened the risk appetite. In the currency space. The dollar slightly dipped thanks to Powell, providing some room for G10 currencies to fight back.