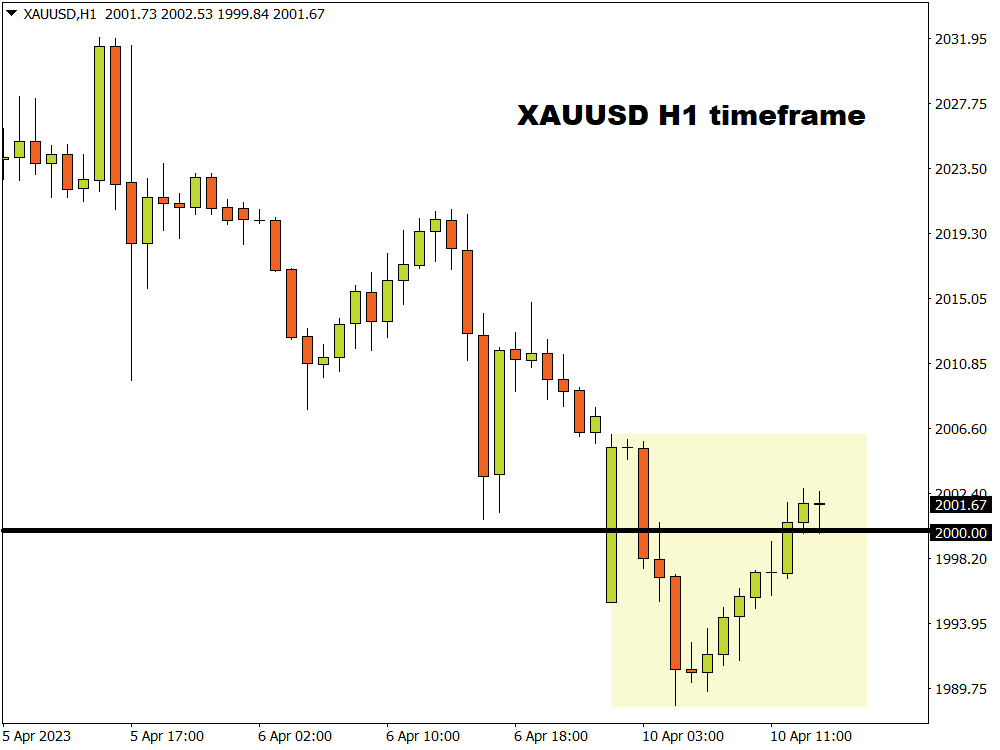

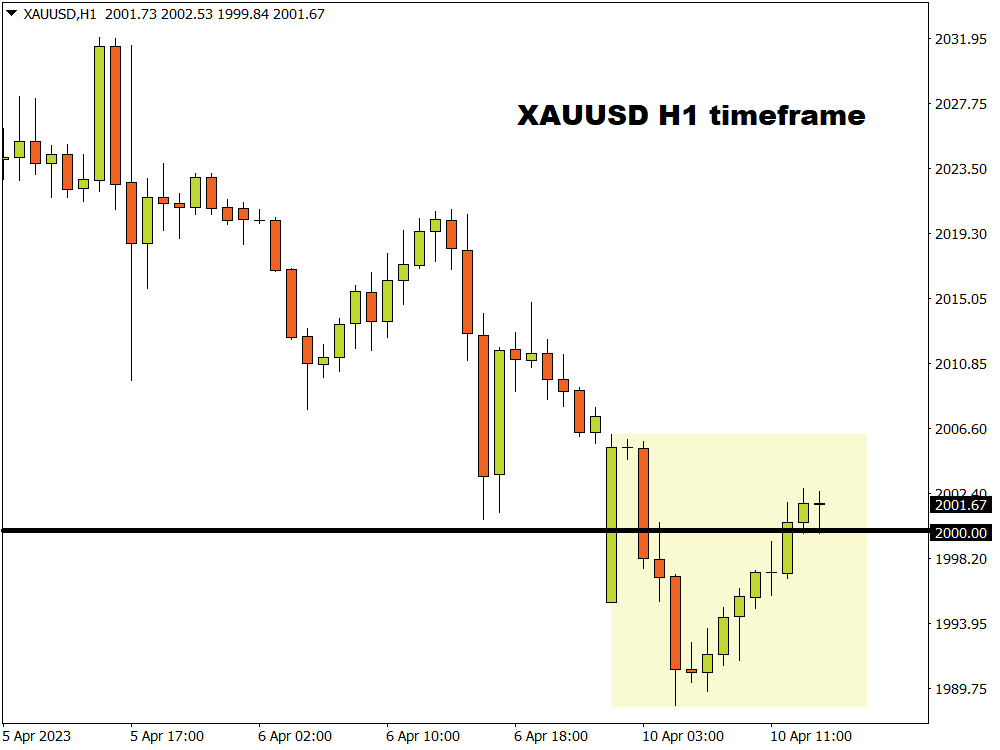

Gold prices shed as much as 1% on Monday morning after closing above the psychological $2000 level last week. Prices later recovered thanks to a weaker dollar and heightened geopolitical tensions over Taiwan.

Trade Of The Week: Another Volatile Week For Gold?

Gold prices shed as much as 1% on Monday morning after closing above the psychological $2000 level last week. Prices later recovered thanks to a weaker dollar and heightened geopolitical tensions over Taiwan.

Week Ahead: SPX500_m braces for double whiplash

Even as we await the pivotal US jobs report due later today (Friday, April 7), while noting that US stock markets have the day off on this Good Friday, traders and investors are also keenly aware of the slate of market-moving events due over the coming week.

Dollar steadies near long-term support

The greenback has tumbled since topping out and printing a “doji” candle around a month ago at 105.88 on the widely followed DXY index. The low print yesterday at 101.41 was down over 4% from that peak as the USD has struggled with a huge reset of Fed rate hike bets. Policymakers are very much data dependent with much focus on the non-farm payrolls report out tomorrow amid holiday-thin markets and next week’s US CPI data. Strong support should be found around the early February bottom at 100.82.

Markets Stabilise After Surprise OPEC+ Cut

European shares were painted green on Tuesday even as oil prices extended gains following the unexpected production cuts from OPEC+ on Sunday. However, a sense of caution lingered in the air with US equity futures pointing to a mixed open amid the prospects of higher oil prices fueling fears of higher inflation. In the currency space, the dollar found itself pressured by weak economic data and expectations around the Fed potentially pivoting down the road.

Trade Of The Week: More Volatility For AUDNZD After OPEC+ Shocker?

Following the OPEC+ shocker overnight, commodity currencies have rallied against the New Zealand dollar.

Given the cartels decision to lower oil output by over 1 million barrels per day starting from May, that promises more support for the likes of AUD, CAD and NOK in the months ahead.

Week Ahead: US jobs report may move these 3 markets

Despite the holiday-shortened week ahead for US and UK financial market, the US March nonfarm payrolls (NFP) report is set to grab hold of traders and investors’ attentions.

The NFP is due at the end of a week that also features these economic data releases and events:

Monday, April 3

Yen sinks as risk mood improves

Markets are enjoying the fading turmoil from the banking crisis with the Nasdaq 100 especially notable with its recent outperformance. The tech-laden index is up over 20% from its December lows as megacap growth stocks lap up the lower interest rate environment sparked initially by the recent market upheaval. The longer-term impact of the turmoil is yet to sink into the wider economy. But tighter credit and potential regulations will have a dampening effect on economic activity and may also curb the Fed’s appetite for higher rates ahead.

Mid-Week Technical Outlook: US Indices In Focus

European shares pulsed with life on Wednesday, echoing the upbeat mood in Asian markets after Chinese tech giant Alibaba announced it will split into six business groups.

Trade Of The Week: EURAUD Major Breakout On The Horizon?

If you have an appetite for volatility, then keep a close eye on the EURAUD!

The currency pair has rallied over 550 pips since the start of March with bulls smashing through key levels of resistance with the destructive force of a wrecking ball. After hitting a fresh 2023 high at 1.6254 last week and concluding on a firm note, the path of least resistance certainly points north.