The mighty dollar hit fresh multi-decade highs this morning as more hawkish Fed speakers and rising Treasury yields injected bulls with fresh inspiration.

Mid-Week Technical Outlook: Dollar Dominates FX Space

Caution Prevails As Investors Remain On Edge

European stocks crept higher on Tuesday, rebounding after a rocky start to the trading week as investors remained jittery over rising interest rates and risks of a global recession. Oil bulls made a return this morning too, pushing the global commodity over 2% higher after collapsing to levels not seen since January 2022.

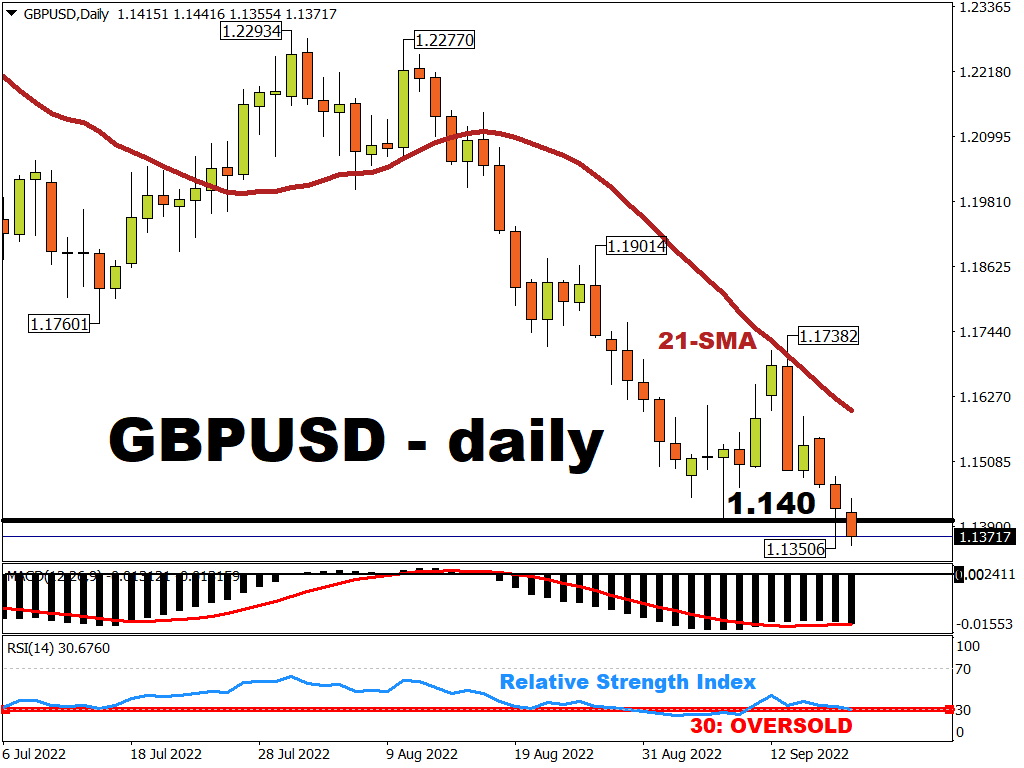

Trade Of The Week: GBPUSD To Plunge Deeper Into Abyss?

Week Ahead: Hawkish "Fed speak" may lift USD Index to fresh two-year high

Hawkish Fed officials, fresh out of the just-concluded FOMC meeting, are set to swoop in en masse on global financial markets in the coming week.

Traders and investors worldwide will be closely monitoring the slew of speeches by officials out of the world’s most influential central bank, amid these other major economic data releases and events in the final days of Q3 2022:

Why FX markets react to central banks?

This week has been jam-packed with major central bank decisions that have triggered wild swings across FX markets.

Here’s a quick catch up:

Mid-Week Technical Outlook: G10 Currencies

A wave of risk aversion whacked financial markets on Wednesday after President Vladimir Putin declared a partial mobilization over Ukraine and accused the West of ‘nuclear blackmail'.

This negative development hit stocks as investors rushed to safe-haven destinations like the dollar, gold, and government bonds. With tensions likely to escalate between Russia and Ukraine following the latest news, risk-off may remain the name of the game ahead of the Federal Reserve rate decision this evening.

Markets Cautious Ahead Of Fed Meeting

European shares edged cautiously higher on Tuesday as investors braced for a busy trading week, jampacked with central bank decisions and headlined by the U.S Federal Reserve.

Trade of the Week: GBPUSD to sink further?

GBPUSD has entered this trading week at its weakest levels since 1985!

And it’s not just GBPUSD that’s winding back the clocks to the 1980s.

Week Ahead: Fed to fan red-hot US dollar?

The coming week will feature central bank decisions galore!

Take your pick: the US Federal Reserve, the Bank of England (meeting delayed from last week), the Bank of Japan, and Norges Bank (the central bank of Norway) are all set to hold their respective policy meetings.

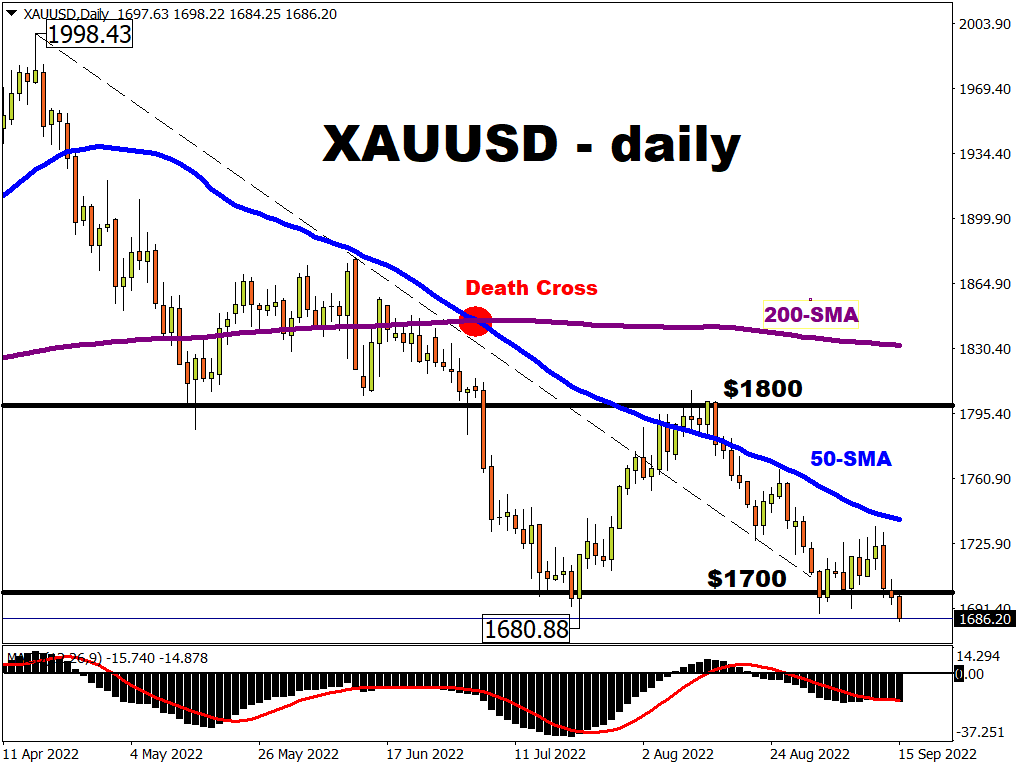

Why is gold back below $1700?

Spot gold is currently trading below the psychologically-important $1700 level, and is on course towards revisiting the lows seen in mid-June.

Here are more data points that make for gloomy reading for gold bulls (those hoping that gold prices will climb):