Dollar bulls dominated the FX space during the first half of 2022, trampling any obstacles that came their way. G10 currencies were practically flattened by the greenback’s might with the pound shedding 10% and yen over 15%.

Trade Of The Week: Are Dollar Bulls Running On Empty Fumes?

Dollar bulls dominated the FX space during the first half of 2022, trampling any obstacles that came their way. G10 currencies were practically flattened by the greenback’s might with the pound shedding 10% and yen over 15%.

Week Ahead: GBPUSD upside likely capped around 1.24

Various asset classes, from FX to stocks, have been swayed by how central bankers are going about trying to tame surging global inflation.

That theme will continue to be the focus in the coming week:

Monday, August 15

Is the worst over for US stocks?

The S&P 500 index is widely used as the benchmark to gauge how overall US stocks are performing.

And much has already been made about the selloff that had persisted through the first half of this year, driven by fears that the Fed will send US interest rates soaring (which it has, by 225 basis points since March).

Mid-Week Technical Outlook: Breakouts

A sense of anticipation has gripped financial markets as investors brace for the latest US inflation report this afternoon.

Inflation is expected to cool 8.7% in July compared with 9.1% in June. As highlighted on multiple occasions this week, the pending report could spark explosive levels of volatility given the market obsession with rising prices.

Markets mixed as spotlight shines on US CPI

Asian shares struggled for direction this morning as concerns about inflation and the outlook for economic growth weighed on sentiment. Overnight, Wall Street’s main indices were mostly flat with a sales warning from Nvidia dragging down the tech sector. In Europe, stocks are expected to open lower due to the growing caution ahead of the US inflation report on Wednesday.

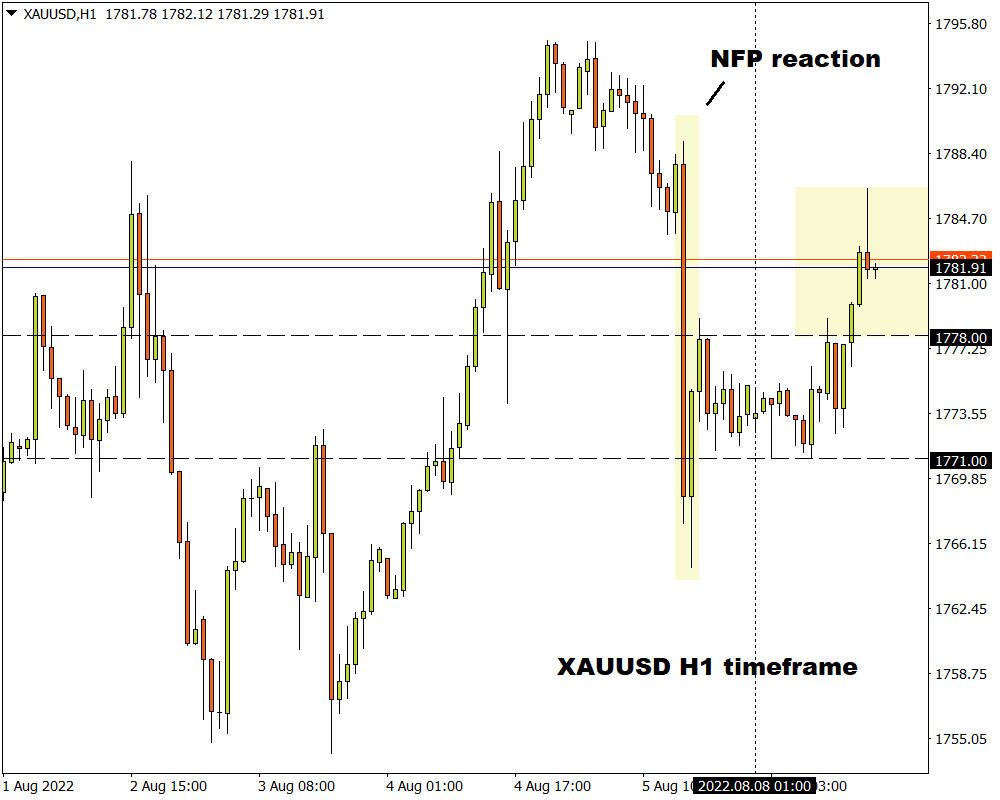

Trade Of The Week: What Next For Gold As Focus Shifts To US CPI?

Gold kicked off the week on a steady note despite last Friday’s blowout jobs report cooling recession fears and reinforcing expectations for more aggressive Federal Reserve interest rate hikes.

Week Ahead: Persistent inflation to revive Dollar bulls?

Inflation angst could make its jarring presence felt once more, as the upcoming US inflation data release holds court amidst the coming week’s global economic calendar:

Monday, August 8

BOE Decision: What you need to know

When is it due?

The BOE is widely expected to raise the UK bank rate by 50 basis points (bps) today.

Bond yields move lower, stocks too

Asian stocks have kicked off August on the back foot as US-China tensions stir safe-haven demand. This follows on from US equities, that snapped a three-day win streak after capping their best month since 2020 last week. Trading volumes are typically thinner during summer as European traders especially are running flat trading books during the holiday season. This means volumes will be a fraction of the size of normal trading activity which can exacerbate price action and swings.