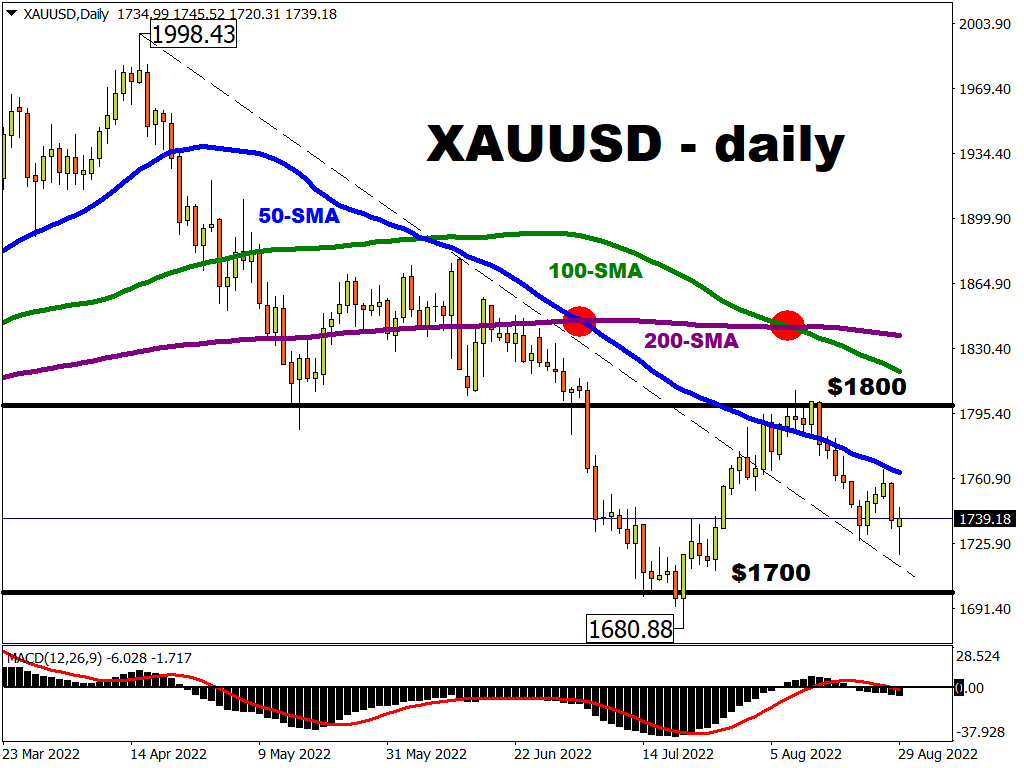

This could be another big week for king dollar as all attention falls on Friday’s nonfarm payroll report.

After receiving fresh inspiration from Fed hawks last week, the greenback could charge higher if the pending US jobs data ticks all the boxes for more aggressive rate hikes. Alternatively, bulls may be humbled if the data fails to meet expectations. Whatever the outcome on Friday, it may be wise to brace for explosive levels of volatility, especially in the FX space.