If you are not already keeping a close eye on the euro, then what are you waiting for?

The currency hijacked market headlines last week after hitting parity for the first time in 20 years!

Trade Of The Week: EURUSD Poised To Settle Below Parity?

If you are not already keeping a close eye on the euro, then what are you waiting for?

The currency hijacked market headlines last week after hitting parity for the first time in 20 years!

Week Ahead: Euro Volatility To Intensify Ahead Of ECB?

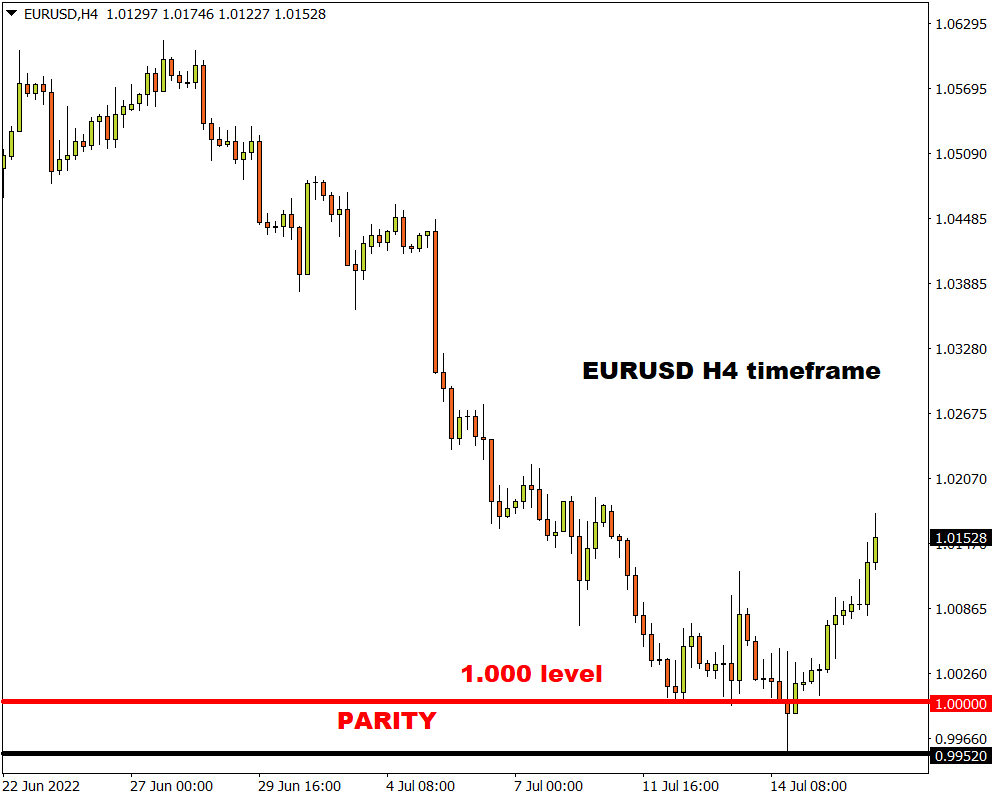

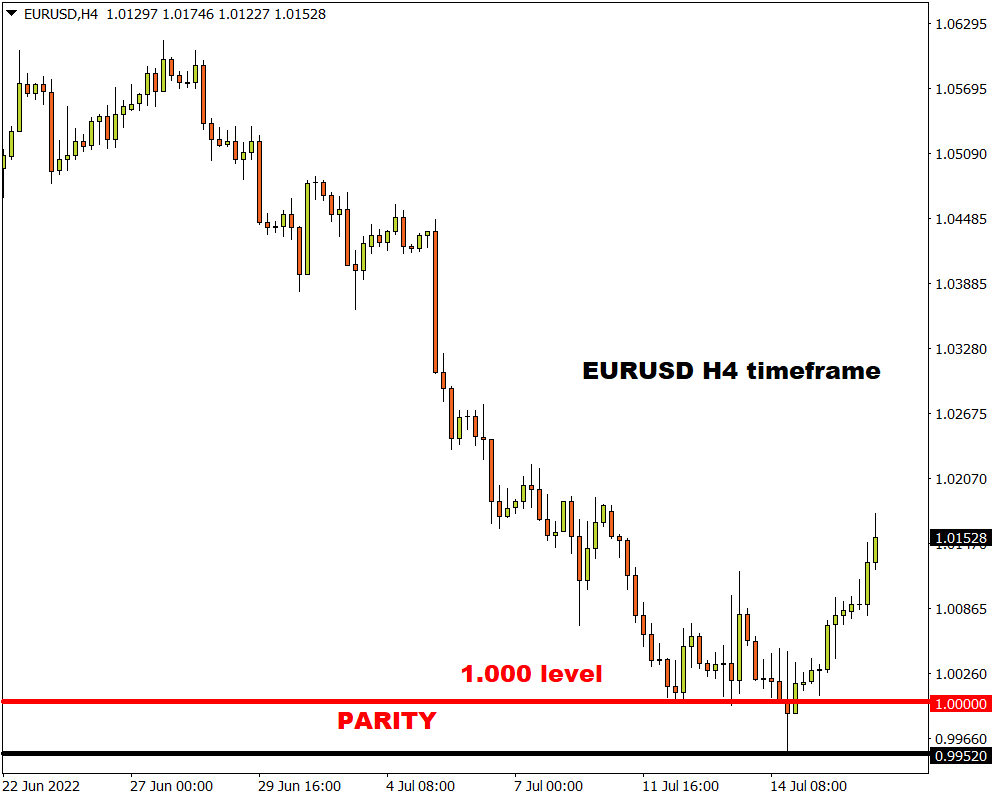

Everybody was talking about the euro after the currency hit its lowest level in nearly two decades, flirting with parity amid the widening policy divergence between the Fed and ECB.

The price action around the psychological 1.000 level felt like a fierce tug of war between bulls and bears with no clear winner in sight. Indeed, various fundamental forces were at play – placing traders on an emotional rollercoaster ride all week!

Why isn't EURUSD below parity ... yet?

First, allow me to confess: I wasn’t expecting to write this article about EURUSD parity so soon.

When I published my Q3 outlook a couple of weeks ago, there was a 72.5% chance that EURUSD would hit 1.000 sometime this quarter.

Even with such elevated odds back then, I still thought this post-parity article wouldn’t be due for another few weeks.

Trade Of The Week: More Pain Ahead For Gold?

The past few weeks have been rough for gold.

After securing a solid weekly close below the $1825 level back in late June, bears were injected with fresh inspiration as various fundamental forces fuelled the downside momentum. The precious metal is down almost 4% this month with prices trading at levels not seen since September 2021!

Week Ahead: Higher-than-expected US inflation could see more USD strength

Inflation.

You’re probably sick of hearing about it, and likelier still to be sick of living with it.

But that doesn’t mean that markets will ignore it.

UK political drama adds to GBP’s woes

News that Boris Johnson has resigned as UK Prime Minister offered scant relief for the British Pound.

Though climbing some 0.4% at the time of writing, GBPUSD is straining to hang on to the psychologically-important 1.20 level.

Today’s bounce could be down to some price action surrounding the rumour and the fact, noting that expectations surrounding Johnson’s resignation had been bubbling for some time now.

Trade Of The Week: Volatile Week For Dollar As Focus Shifts To NFP?

The mighty dollar reigned supreme during the first half of 2022, asserting its dominance over all G10 currencies.

Due to the upcoming Eid al Adha holiday on 11.07.2022 in Kenya, there will be temporary changes to FXTM’s trading schedule.

Please refer to the table below for the schedule of all the instruments that are subject to changes. If your instrument is not mentioned, that means normal trading will resume for it.

FXTM11.07.2022

CFD Kenya Stocks > *Closed

Kenya Stocks > *Closed

*All hours are provided in EET (Eastern European Time) – Server Time in MT4.

Week Ahead: USDCHF to fall on US recession fears?

Market chaos reigned throughout the first half of 2022. Bond yields, oil prices and the US dollar soared to levels not seen in over a decade, while the S&P 500 experienced its worst first half of the year since 1970.

But that doesn’t mean market volatility is now done and over with.

Due to the upcoming HKSAR Establishment Day & US Independence Day from 01.07.2022-04.07.2022, there will be temporary changes to FXTM’s trading schedule.

Please refer to the table below for the schedule of all the instruments that are subject to changes. If your instrument is not mentioned, that means normal trading will resume for it.