Markets are set to remain gripped by the effects of soaring inflation on companies’ bottom lines and on the performance of major economies.

Equities plunge as selling returns to risk markets

US equities tumbled on Wednesday as they suffered their worst day since the early months of the pandemic in June 2020. The benchmark S&P500 fell 4% with 98% of stocks declining.

Sentiment Shaky On Global Growth Worries

It’s a new week but the same old story for financial markets as global growth concerns and inflation fears leave investors on edge.

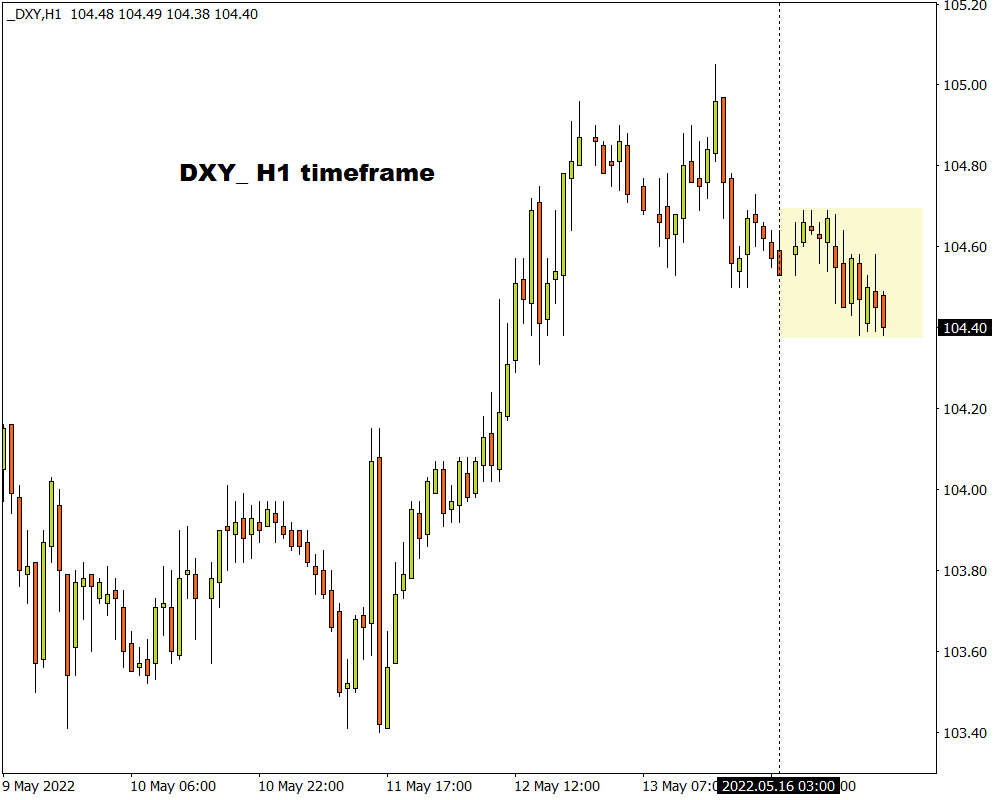

Trade Of The Week: Is The Dollar’s Advance Unstoppable?

The mighty dollar kicked off the week in a shaky fashion despite crossing above 105.0 last Friday, its highest level since December 2002!

Week Ahead: Sterling to sink to greater depths?

The market adage “Sell in May and go away” has certainly rung true in 2022.

The selloff across bonds, stocks, and even cryptos has taken a steeper dive so far this month, amid worries that central bank rate hikes could choke the global economy.

S&P 500 set for ‘bear market’. How much further can US stocks fall?

The S&P 500 is set to drop further when US markets open today, potentially marking a 5th session of losses over the past six.

This blue-chip index is down almost 18% from its record high set on January 3rd this year, almost meeting the threshold for a ‘bear market’.

Markets Dive On Growth Fears

Asian equities remained under pressure on Tuesday as the massive sell-off across financial markets left investors bloodied and worried. Although European futures are pointing to a positive open despite the overall market caution, the lack of appetite for risk may cap upside gains. Mounting fears around rising interest rates and slower global economic growth hammered global sentiment yesterday, with risk assets feeling the burn.

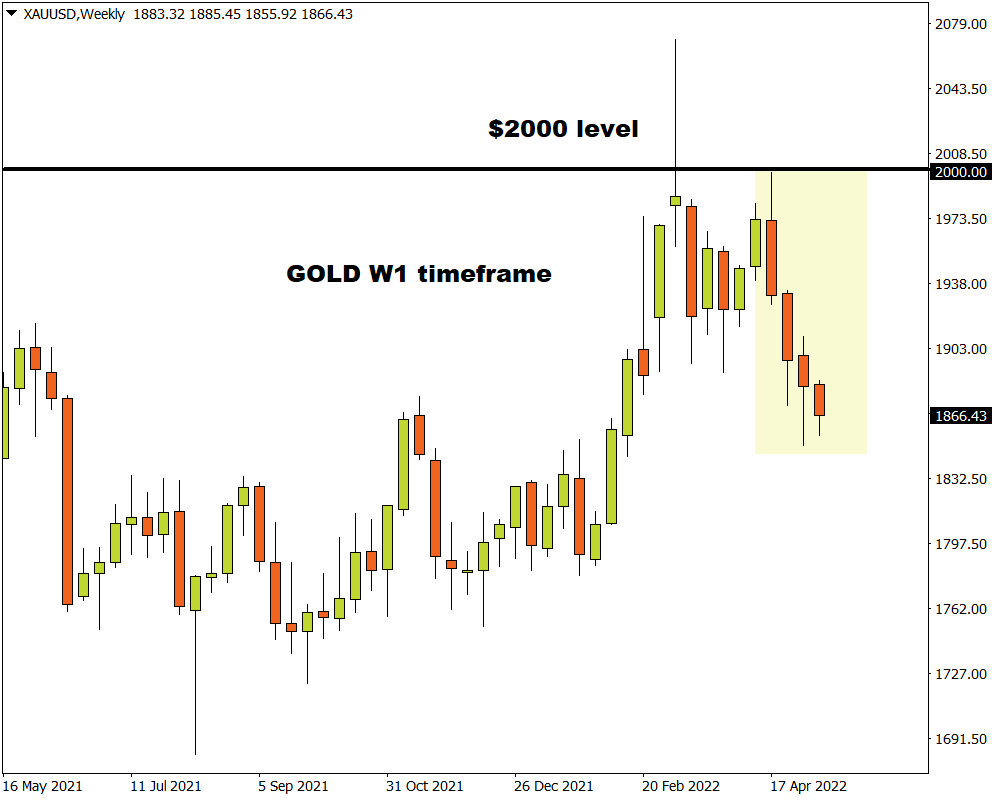

Trade Of The Week: Will Gold Prices See More Pain?

The past few weeks have certainly not been kind to gold.

After almost kissing the psychological $2000 level back in mid-April, bulls ran out of steam – allowing bears to drag the precious metal to prices not seen since February 2022!

Due to the upcoming Victory Day in Russia and Buddha's Birthday in HK holidays from 09.05.2022-10.05.2022, there will be temporary changes to FXTM’s trading schedule.

Please refer to the table below for the schedule of all the instruments that are subject to changes. If your instrument is not mentioned, that means normal trading will resume for it.