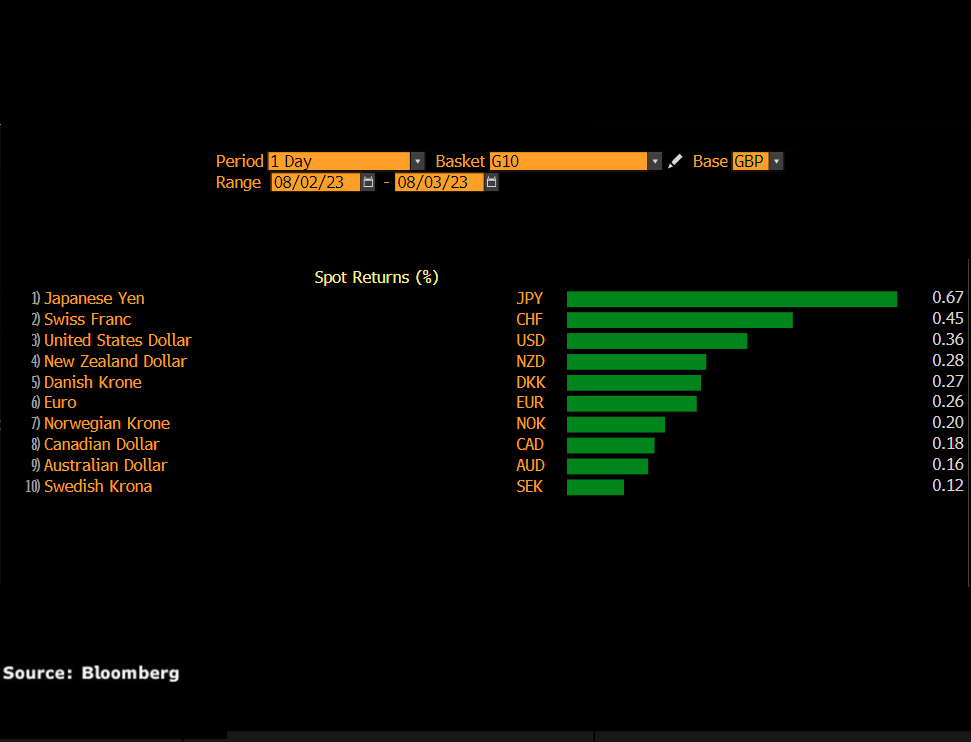

Sterling is getting no love ahead of the highly anticipated Bank of England (BoE) rate decision today.

Fitch downgrades US: What you need to know

US Treasury Secretary Janet Yellen “strongly disagreed” with Fitch’s decision, blasting it as “arbitrary and based on outdated data”.

But that hasn’t stopped global markets from adopting a slightly risk-off mode for the time being:

Markets Brace For Another Event Heavy Week

Asian markets were a mixed bag on Tuesday as weak China data countered the initial optimism set off by Wall Street overnight, after the benchmark S&P 500 notched its fifth consecutive monthly gain. European shares are flashing red amid the market caution with risk appetite taking another hit thanks to disappointing manufacturing activity data. Looking at currencies, the USD seems to be drawing strength from the tense mood while the Australian dollar has weakened across the board after the Reserve Bank of Australia left interest rates unchanged.

Trade Of The Week: GBPUSD Twitchy Ahead Of BoE

Sterling could kick off the new trading month with a bang as focus falls on the Bank of England rate decision.

After posting a mixed performance across the G10 space in July and gaining over 1% versus the dollar, could volatility return in August?

Week Ahead: US NFP Report May Rock These 3 Markets

If you thought this was a volatile week jampacked with high-risk events, then just wait until you see what’s in store for the first week of August…

Mid-Week Technical Outlook: Calm Before Fed Storm?

An air of tension settled over financial markets on Wednesday as investors braced for the pivotal Fede

China stimulus hopes lift sentiment but caution lingers

Trade Of The Week: NQ100_m In Focus As Rebalancing Kicks In

If you have an appetite for volatility, then keep a close eye on the NQ100_m!

This could be a wild week for the index thanks to high-risk events ranging from a special rebalancing which takes effect today, to Big Tech earnings and the major Fed decision.

Despite the technical pullback witnessed last week, the NQ100_m which tracks the underlying Nasdaq 100 index remains a bullish trend.