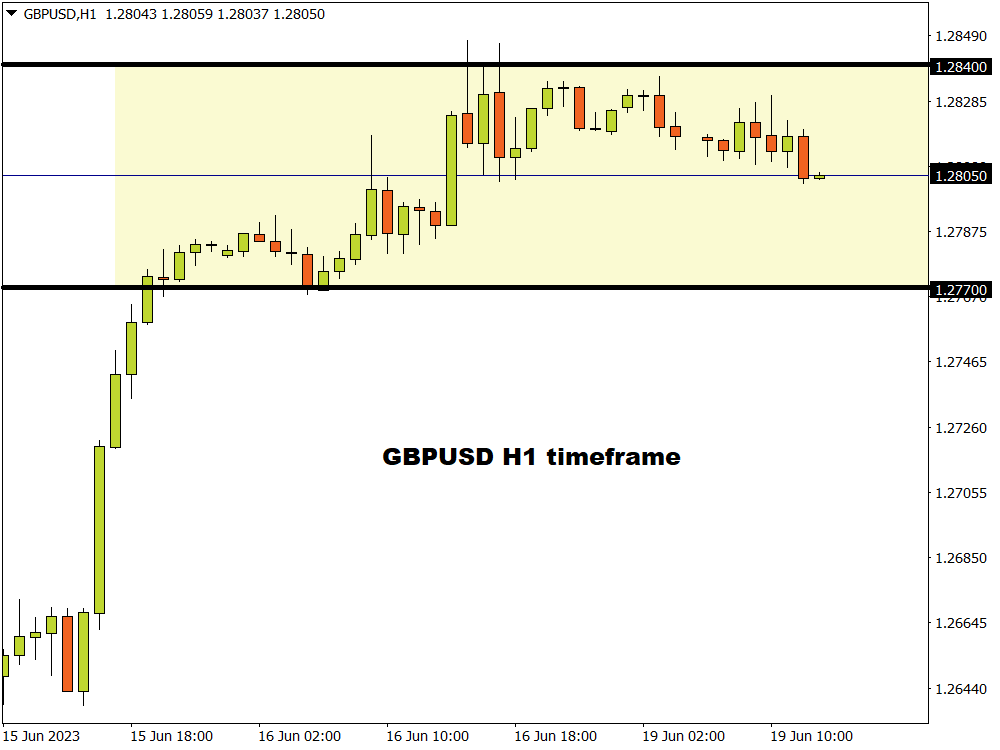

The GBPUSD remains choppy on the daily timeframe but bulls linger in the vicinity. Further upside could be on the cards, especially after prices created a potential new impulse wave.

With just over an hour left until the BoE rate decision, here is watch to watch out for on the technical front: