The SPX500_m index seems to be in a sturdy uptrend on the H4 timeframe with prices making a higher top at 4301.6 on Monday 5th June.

Markets Enter Standby Mode

Asian stocks crawled higher on Wednesday, following the positive cues from Wall Street overnight after the S&P 500 closed at its highest level in 2023. However, markets remain cautious despite hopes for stimulus in China with risk sentiment shaky after the World Bank’s warning on the global economic outlook. European futures are pointing to a cautiously positive open despite the industrial production figures for Germany rising less than expected in April. In the currency markets, the dollar seems to be on standby amid the absence of a fresh fundamental spark.

AUD climbs after surprise RBA hike

AUDUSD soared by as much as 0.92% and breached the 0.6680 level, before paring some of its gains at the time of writing.

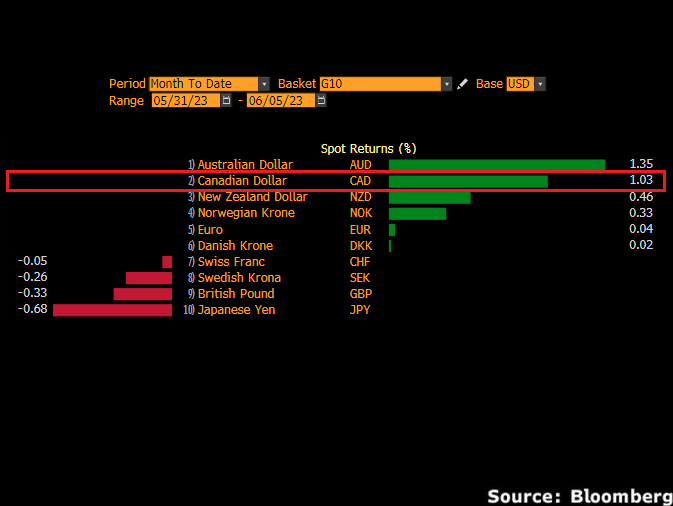

Trade Of The Week: Time For USDCAD To Breakout?

The Canadian Dollar is the second-best performer against the US dollar so far in June, gaining 1% thanks to higher oil prices and increased expectations around a BoC rate hike.

Week Ahead: OPEC+ to shock Brent back to $80?

This critical decision could rock oil prices at the onset of the coming week, which also features these major events on the global macroeconomic calendar:

EURUSD attempts slight recovery

EURUSD's move higher at the time of writing is in spite of the just-released Eurozone inflation data for May, as measured by the consumer price index (CPI), arguing for greater declines for the bloc's currency.

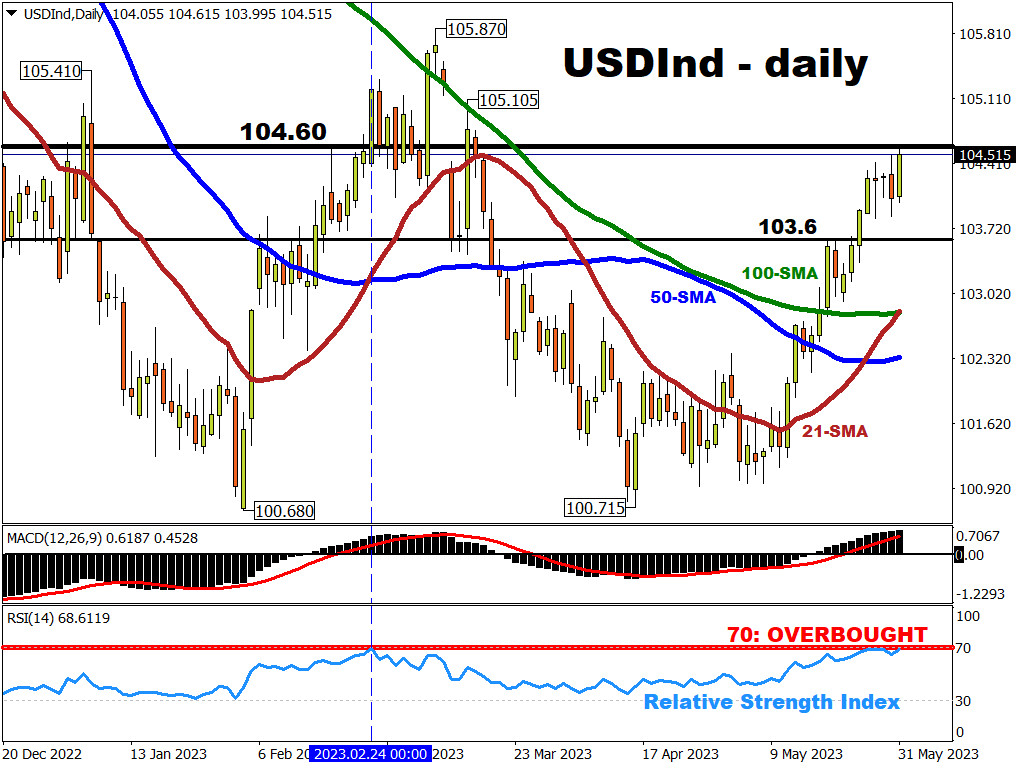

Why is the US dollar stronger today?

The USD Index has punched its way to a fresh two-month high, and is on course for its largest monthly gain (2.8%) since September 2022.

NZDJPY D1 – The bears are stirring

The NZDJPY bulls on the D1 time frame have been making higher tops and bottoms since the beginning of May.

A last higher top was reached when the price bounced off a weekly resistance level on 23 May at 87.304.

A closer look at the Momentum Oscillator reveals negative divergence between point “a” and “b” when comparing the tops at 86.173 and 87.304.

Trade of the Week: EURUSD set for rebound?

The euro has weakened against the US dollar by about 2.7% so far this month, as we see out the final days of May.

Week Ahead: On the brink of crisis

Despite the holiday-shortened week ahead for US and UK financial markets, the US debt ceiling saga will remain centre stage as the clock ticks towards a potential June 1st “hard deadline”.

On top of this, traders will be dished up a series of top-tier economic data including the NFP, which could trigger more market volatility:

Monday, May 29